Property Tax FAQ

Why did my property taxes go up so much?

Property tax values are affected by property value assessments from the Montana Department of Revenue and by levies and assessments on the taxable value of the property.

What is Taxable Value and why is it used for taxes instead of Market Value?

In Fiscal Year 2018, most of the county taxes saw modest increases based on a flat taxable value. Unfortunately, taxable values increased across the county by an average of 10% and schools had a large impact across the county. As discussed below, there are permissive levies allowed by Montana state code. In the 2017 legislative year, the state created or allowed a higher level of permissive levies for the schools to allow for more local control. This has had a large impact on everyone regardless of changes in taxable value.

Compare Year to Year Property Tax Changes

The best way to determine where tax increases come from is to compare last year’s and this year’s tax bills. Tax Bill Link – Find your tax bills. For the prior year, click on History and then click on “Statement#” for the year you want.

*** One great feature to review is the View Pie Charts which contains 5 charts. Drill down to see more detail on your tax bill and breakouts from State, County, School, City and Other all the way down to each line of the tax bill. ***

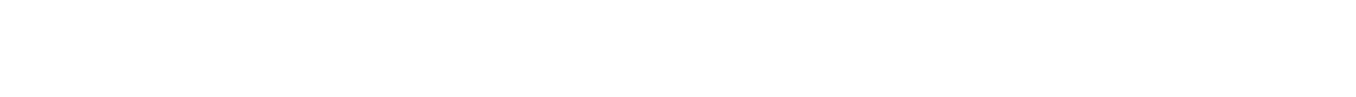

- In the upper right corner of the tax bill is the taxable value.

Did the taxable value increase significantly?

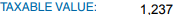

Did the taxable value increase significantly? - Next, look at the actual tax bill line by line, review the breakdown listed 2/3 down the tax bill page, or look at the pie charts to compare data. This will show where the increases are in the current year.

- Line Item View

- Review the breakdown or pie charts to see rolled up information.

How are Property Taxes Determined?

There are 3 types of levies allowed in Montana. The type of levy defines how many mills can be charged annually.

- Non-Voted (Floating) Mills – Annual Mills capped by revenue restrictions. For an example, see Park County FY2018 Budget Page 179

- Permissive Mills – Annual Mills allowed by state law to be levied for specific purposes to raise needed funds (Permissive medical levy and some school levies, for example).

- Voted $ or mills – Taxpayer voted fixed mills or fixed dollars (Library voted levy, etc).

In addition, there are assessments charged for living in a particular district or for services such as Refuse.

To see Park County's FY2018 Levies and Assessments excluding Cities, Schools and Agencies, see Park County FY2018 Budget Page 173 to 174

The Montana Department of Revenue contains more information about property taxes in Montana:

- Property Assessment Division - Montana State Department of Revenue Home Page

- My Property - Look up specific property details

- Property Assessment Cycle – Resource for Annual Assessment Schedule

- Detailed Certified Values For Each County – Resource for Park County Market and Taxable Values broken out by County, City and Agencies. Multiple years are available for download.

- Certification of Values – Example of Floating Mill Calculation for Non-Voted Levies (Floating for Inflation and new property)

Contact Information

Park County does not directly handle City, School or Agency budgets. Please contact the specific City, School or Agency to ask questions.

- Property Assessment - Department of Revenue – (406) 222-4919

- County Tax Appeal Board Hearing Instructions - Carly Ahern, CTAB Secretary - (406) 222- 4106

- Park County Accounting/Finance – Erica Strickland, Park County Finance Director – (406) 222-4135

- City of Livingston

Livingston Schools:

Dr. Don Viegut

222-0861

Shields Valley Schools:

Billi Taylor

578-2535

Gardiner Schools:

Randy Russell

848-7563

Pine Creek School:

Dr. Kim DeBruycker

581-8446

Arrowhead School:

Jo Newhall, County Supt of schools

222-4148

Cooke City School:

Jo Newhall, County Supt of schools

222-4148